how much state tax do you pay on a 457 withdrawal

The 457 is similar to the more widely known 401k plan where you can choose to contribute to the 457 plan through automatic deductions from your paycheck before the taxes are taken out. You will still owe income taxes on the withdrawal although you can spread out the taxes over three years.

/AP_401146136212-600579d89b014f62b098ed5ab375a3fc.jpg)

Are 457 Plan Withdrawals Taxable

Finally retirement contributions you make to an employer-sponsored retirement plan such as a 401k 403b or 457 are typically made on a pre-tax basis and therefore are excluded from your.

. If you do not want the childs benefit to be paid to that person have your attorney set up a trust and. The PERSTRS cannot pay benefits directly to a minor. If you qualify and take the withdrawal during 2020 then the 10 penalty for early withdrawal will be waived.

Avoid a penalty by filing and paying your tax by the due date even if you cant pay what you owe. In California you have a wide variety of. File online using one of our electronic filing options.

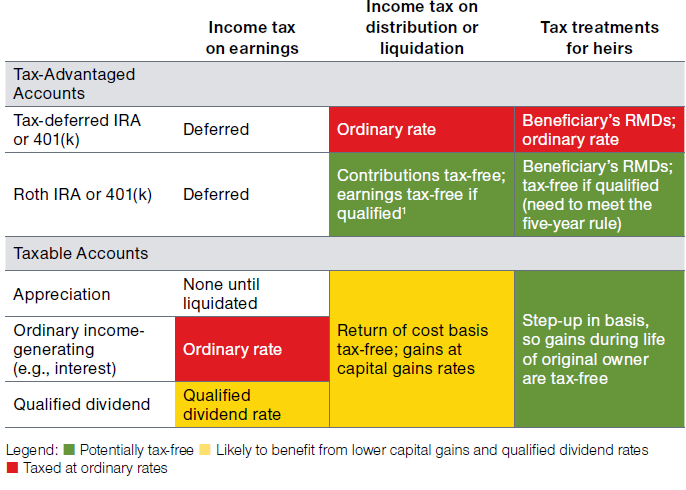

It works like this. While you do not get an upfront tax deduction the investments grow tax-free and will be completely tax-free at the time of withdrawal. You decide within certain Internal Revenue Code IRC limits how much of your income you want to defer.

For example if you withdraw 12000 from your 401k you can choose to claim 4000 of income in 2020 2021 and 2022. These work precisely the same way as in a 401k or 403b. Apply online for a payment plan including installment agreement to pay off your balance over time.

Your employer will reduce your paycheck before withholding federal and if applicable state income tax by. If you roll the money into a Roth IRA eventually you can even avoid having to take RMDs. Also like the 401k money grows tax-deferred in a 457 retirement account until the time you withdraw the money.

Some 457b plans allow Roth contributions. If you must make a hardship withdrawal from your 401k before you reach the age of 59 and a half years old your withdrawal will be subject to income tax and a 10 withdrawal penalty. For individuals and businesses.

You dont have to pay back the money withdrawn like you would a loan from a 401k which means your retirement account balance is permanently reduced by the. When you withdraw the account at retirement you may take your withdrawal in the form of a lump sum payment life annuity or in installments over a designated period of time. With a 457b deferred compensation plan you postpone receiving defer a portion of your salary.

In New York you can use your online services account or call 518 457-5434 to pay your tax bill. Tax Forms and Rates What methods can be used to file an individual income tax return.

What Is A 457 B Plan Forbes Advisor

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

How A 457 Plan Works After Retirement

Massachusetts Retirement Tax Friendliness Smartasset

How To Make Your Retirement Account Withdrawals Work Best For You T Rowe Price

Moving Out Of State Don T Forget About The Source Tax Mullin Barens Sanford Financial

What Are Defined Contribution Retirement Plans Tax Policy Center

Tax Form 1099 R Jackson Hewitt

The Most Tax Efficient Sequence Of Withdrawal Strategy Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Do You Need To File A Tax Return In 2018

457 B Plan Retirement Plan Advisors

:max_bytes(150000):strip_icc()/ScreenShot2021-12-15at3.19.44PM-291c5fe0726d489fb990ff40378b295f.png)

Form 5329 Additional Taxes On Qualified Plans Definition

Pension Fund Tax Deferred Retirement Account 403 B Roth 403 B

How To Access Retirement Funds Early Retirement Fund Financial Independence Retire Early Traditional Ira

6 Simple Truths About Retirement Retirement Planning Money Savvy Money Life Hacks

What Makes A 457 B Plan Different

How Are My Taxes Affected By Receiving A Lump Sum Of Income Www Chadpeshke Com